1111 – Financial auditors and accountants

Financial auditors examine and analyze the accounting and financial records of individuals and establishments to ensure accuracy and compliance with established accounting standards and procedures. Accountants plan, organize and administer accounting systems for individuals and establishments. They are employed by private sector accounting and auditing firms or departments and public sector accounting and auditing departments or units, or they may be self-employed. Articling students in accounting firms are included in this unit group.

Profile

Example titles

- Accountant

- Chief accountant

- Financial auditor

- Income tax expert

- Industrial accountant

- Internal auditor

Main duties

This group performs some or all of the following duties:

Financial auditors

- Examine and analyze journal and ledger entries, bank statements, inventories, expenditures, tax returns and other accounting and financial records, documents and systems of individuals, departments within organizations, businesses or other establishments to ensure financial recording accuracy and compliance with established accounting standards, procedures and internal controls

- Prepare detailed reports on audit findings and make recommendations to improve individual or establishment’s accounting and management practices

- Conduct field audits of businesses to ensure compliance with provisions of the Income Tax Act, Canadian Business Corporations Act or other statutory requirements

- May supervise other auditors or professionals in charge of accounting within client’s establishment.

Accountants

- Plan, set up and administer accounting systems and prepare financial information for individuals, departments within organizations, businesses and other establishments

- Examine accounting records and prepare financial statements and reports

- Develop and maintain cost finding, reporting and internal control procedures

- Examine financial accounts and records and prepare income tax returns from accounting records

- Analyze financial statements and reports and provide financial, business and tax advice

- May act as a trustee in bankruptcy proceedings

- May supervise and train articling students, other accountants or administrative technicians.

Employment requirements

- Chartered professional accountants, chartered accountants (CPA, CA) require a university degree and completion of a professional training program approved by a provincial Institute of Chartered Accountants and, depending on the province, either two years or 30 months of on-the-job training and membership in a provincial Institute of Chartered Accountants upon successful completion of the Uniform Evaluation (UFE).

- Chartered professional accountants, certified general accountants (CPA, CGA) and chartered professional accountants, certified management accountants (CPA, CMA) require a university degree and completion of an approved training program and several years of on-the-job training and certification with a regulatory body is required in all provinces and territories.

- Auditors require education, training and recognition as indicated for chartered professional accountants, chartered accountants (CPA, CA), chartered professional accountants, certified general accountants (CPA, CGA) or chartered professional accountants, certified management accountants (CPA, CMA) and some experience as an accountant.

- Auditors may require recognition by the Institute of Internal Auditors.

- To act as a trustee in bankruptcy proceedings, auditors and accountants must hold a licence as a trustee in bankruptcy.

- Licensing by the provincial or territorial governing body is usually required for accountants and auditors practising public accounting.

Additional information

- There is limited mobility among the three professional accounting designations: chartered professional accountant, chartered accountant (CPA, CA); chartered professional accountant, certified general accountant (CPA, CGA), and chartered professional accountant, certified management accountant (CPA, CMA).

- Progression to auditing or accounting management positions is possible with experience.

Exclusions

- Accounting technicians and bookkeepers (1311)

- Financial managers (0111)

- Program or other non-financial auditors (in 416 Policy and program researchers, consultants and officers)

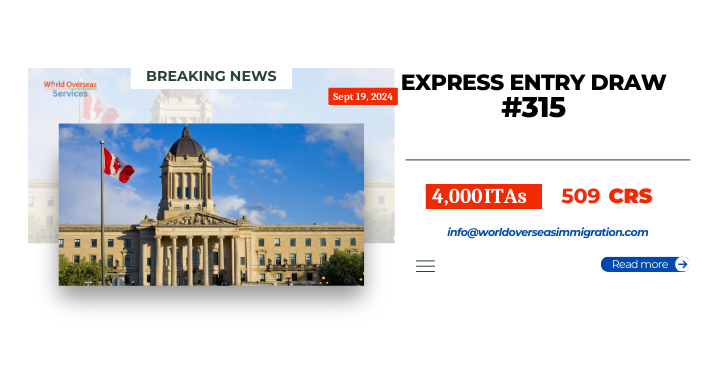

World Overseas Services provide you best guidance for your immigration. If you have any query you can fill the side bar form or you can call us on +919810366117or +918448490107 or just mail us your query at info@worldoverseasimmigration.com

How to contact us

Our office is in South Delhi. You can come in the office directly for any immigration process query. But it will be beneficial for you complete your free assessment visa form before the meeting. So that the consultant has all the knowledge about your profile and he can guide you properly.